PipDaddys

toke

Start Learning Forex with the School of PipDaddys

MAKING MONEY IN FOREX

Labels

IDENTIFYING A BARGAIN DAY

After determining a trend bias the next step is to identify a bargain day.

Chapter 3 introduced you to the concept of finding bargain days, and the

Sitcom System uses them to locate days that potentially offer the best deal

on a trade. Traders often jump into trends at a price that doesn’t represent

the best possible value for their trade. This is usually referred to as

DETERMINING TRENDS

Every trading day has a high and a low edge that you could potentially trade

along, but it isn’t efficient to do so. To increase your chances of selecting

a successful trade, the Sitcom System begins by determining a directional

trend bias through the use of a simple moving average indicator. The rules

Bargain Hunting Along the Edge

This chapter contains the first of three trading methodologies that will

put the support and resistance tactics you learned in Chapter 3 to

good use. In this chapter you will learn a trading methodology I affectionately

refer to as the Sitcom System because it allowed me to trade on

my own schedule, often while I watched a favorite television sitcom. The

system combines what you have learned about support and resistance with

simple price action analysis. The Sitcom System focuses on daily charts,

and for the purposes of this discussion I define the end of the trading day

as 5:00 P.M. Eastern Time. This ensures that both the London and New York

trading days have closed before we begin to plan a trade, allowing us to see

the full range or price action for that trading day.

After each trading day there are two distinct boundaries formed by

support and resistance. The daily high is a boundary that buyers could not

overcome; the daily low is a boundary that sellers could not overcome. The

extreme edges of price action for a trading day mark the front lines in the

battle between buyers and sellers. Traders can use these clearly identified

support and resistance zones to their advantage with the help of simple

price action analysis.

To trade the Sitcom System, you need a trend, a bargain day, a support

or resistance zone, and a profit target. If you’re one of those traders who

believes that a daily chart requires 100 pip stops, you’re about to learn a

much better way to trade long-term charts.

AUTOMATING PROFIT WITH LIMIT ORDERS

Automating profit management through the use of limit orders is just as

important as managing risk through the use of stop orders. It might seem

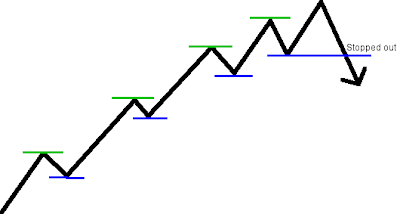

USING TRAILING STOPS

Earlier in this chapter we discussed how breakeven stops and scaling out

can actually add volatility to your trading performance, but what about

trailing stops? Many traders attempt to lock in profits as the market moves

in their favor by trailing the market with their stop order. I rarely use trailing

IDENTIFYING PROFIT TARGETS WITH FIBONACCI RATIOS

As a discretionary trader, using Fibonacci retracement ratios is my favorite

technique for identifying profit targets. Many books discuss using

Fibonacci as a trade entry technique, but I prefer to use them to identify

profit targets. Fibonacci ratios provide a simple and consistent profit management

IDENTIFYING PROFIT TARGETS

Knowing when to take profit on a trade is often a subjective and frustrating

process for many discretionary traders. Often a trade will be closed too

early or open too long while a trader tries to squeeze every last pip out

of it. Without a systemic, repeatable procedure to determine when to take

profits, a trader will never feel truly comfortable with his decision to take

profit, and volatility will continue to be an issue in his returns.

In this section you will learn two of my favorite tactics to identify profit

targets. First, you will learn how to use support and resistance to identify

simple profit targets based on price action. Second, you will learn an advanced

method of identifying profit targets using Fibonacci retracement

and extension ratios.

Identifying Profit Targets with Support and Resistance

COMMON PROFIT MANAGEMENT TECHNIQUES THAT INCREASE VOLATILITY

Regardless of how careful a trader is in planning a trade, there is no guarantee

that the market will reach the intended profit target. Occasionally

the market will come close to a profit target only to reverse direction and

move quickly against a trade. There is nothing more frustrating than setting

a trade in motion only to find out later that you could have taken a profit

but ended up with a loss.

Managing Profit

Complete trade management should include guidelines to enter a

trade, manage risk, and manage when to take profit. Many traders

focus on entering and managing risk but leave managing profit open

to subjective decision making, which is a mistake. Knowing when to take a

profit is important enough to include managing profit as a core trading principle

for bargain hunters. In this chapter you will learn to manage profit

KNOW WHEN TO TAKE A BREAK

Finally, the last mistake I see traders make on a regular basis is refusing

to take a break when their trading is really suffering. I think this applies to

discretionary traders more often than system traders. If you are a system

trader, you probably understand your trading system’s average drawdown

Subscribe to:

Posts (Atom)