toke

Start Learning Forex with the School of PipDaddys

MAKING MONEY IN FOREX

Labels

USING TRAILING STOPS

Earlier in this chapter we discussed how breakeven stops and scaling out

can actually add volatility to your trading performance, but what about

trailing stops? Many traders attempt to lock in profits as the market moves

in their favor by trailing the market with their stop order. I rarely use trailing

stops in my personal trading, but I do recognize the value they provide

when they are used properly. When trailing stops are not used properly,

you will end up adding volatility to your results, just as with a break

even stop.

There are many techniques to managing a trailing stop. Traders often

start moving their stop when the position has earned twice the amount

risked. Another popular technique is to trail the market with a stop placed

near the high or low price over the last three to five candles. Both of these

techniques are effective for short-term results, but they follow arbitrary

rules that are not in tune with the market. Traders using a trailing stop

should take into consideration the relationship between supply and demand

as drawn in support and resistance lines on the chart before moving

a trailing stop. Using support and resistance analysis, a trader will know

exactly when and exactly where she should move a trailing stop.

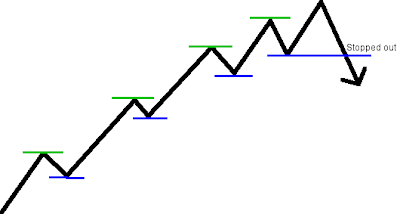

The key to using support and resistance with trailing stops is to wait

for the market to establish a turn. The turn is marked by a pullback followed

by a continuance in the original direction of the market. Depending

on the timeframe you are trading, the turn may take one candle or several

in the case of a daily chart, but waiting for the turn to complete is critical

to successfully moving a trailing stop. Illustrated in Figure 5.8 by waiting

for a turn to complete, the trader has placed his trailing stop in an area the

market has already respected through the principles of support and resistance.

The trader can have confidence knowing the market has tested that

level and continued in his favor. By placing a trailing stop below the turn,

you know it is in a position not likely to be visited by price unless the market

conditions dramatically change. It should be noted that this technique

is valid for use on any timeframe and with any currency pair.

There is one significant difference between using a trailing stop and

using other profit management techniques such as Fibonacci ratios: There

are no set profit targets. Although there is nothing stopping you from having

a profit target in mind, generally speaking, using a trailing stop is about

capturing the most profit you possibly can out of every trade taken. The

trailing stop itself is the only tool used to decide when the trade is over.

When you follow the market using the turns described in this section, your

trade should remain open until a dramatic change occurs, signaling the

end of the trend you are following. Figure 5.8 demonstrates this principal

clearly. Traders who were long USD/CAD and using a trailing stop were

taken out at a profit after selling pressure near $1.17 overcame the bulls.

The opposite occurred to the bears as demand appeared again near the

$1.08 demand level. Using a trailing stop means you should always let the

stop take you out of the market. This should keep you in the trend, following

safely behind the turns for as long as possible.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment