toke

Start Learning Forex with the School of PipDaddys

MAKING MONEY IN FOREX

Labels

USING TRAILING STOPS

Earlier in this chapter we discussed how breakeven stops and scaling out

can actually add volatility to your trading performance, but what about

trailing stops? Many traders attempt to lock in profits as the market moves

in their favor by trailing the market with their stop order. I rarely use trailing

IDENTIFYING PROFIT TARGETS WITH FIBONACCI RATIOS

As a discretionary trader, using Fibonacci retracement ratios is my favorite

technique for identifying profit targets. Many books discuss using

Fibonacci as a trade entry technique, but I prefer to use them to identify

profit targets. Fibonacci ratios provide a simple and consistent profit management

IDENTIFYING PROFIT TARGETS

Knowing when to take profit on a trade is often a subjective and frustrating

process for many discretionary traders. Often a trade will be closed too

early or open too long while a trader tries to squeeze every last pip out

of it. Without a systemic, repeatable procedure to determine when to take

profits, a trader will never feel truly comfortable with his decision to take

profit, and volatility will continue to be an issue in his returns.

In this section you will learn two of my favorite tactics to identify profit

targets. First, you will learn how to use support and resistance to identify

simple profit targets based on price action. Second, you will learn an advanced

method of identifying profit targets using Fibonacci retracement

and extension ratios.

Identifying Profit Targets with Support and Resistance

COMMON PROFIT MANAGEMENT TECHNIQUES THAT INCREASE VOLATILITY

Regardless of how careful a trader is in planning a trade, there is no guarantee

that the market will reach the intended profit target. Occasionally

the market will come close to a profit target only to reverse direction and

move quickly against a trade. There is nothing more frustrating than setting

a trade in motion only to find out later that you could have taken a profit

but ended up with a loss.

Managing Profit

Complete trade management should include guidelines to enter a

trade, manage risk, and manage when to take profit. Many traders

focus on entering and managing risk but leave managing profit open

to subjective decision making, which is a mistake. Knowing when to take a

profit is important enough to include managing profit as a core trading principle

for bargain hunters. In this chapter you will learn to manage profit

KNOW WHEN TO TAKE A BREAK

Finally, the last mistake I see traders make on a regular basis is refusing

to take a break when their trading is really suffering. I think this applies to

discretionary traders more often than system traders. If you are a system

trader, you probably understand your trading system’s average drawdown

IS LOSING 70 PERCENT OF YOUR TRADES BAD?

What would you think if I told you I lost money on 70 percent of my trades?

Would you scoff at my trading performance? Would you think I’m a bad

trader? Or would you be interested in knowing how much I made on the 30

percent of trades on which I made money? Traders tend to focus on winning

and taking profits because nobody likes to lose money and everybody

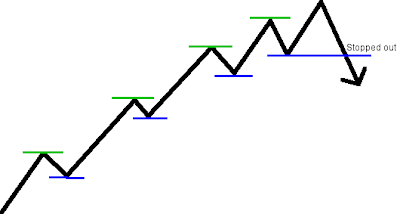

BE CONSERVATIVE WITH TRAILING STOPS

To move or not to move my stop order—that is the question. Emotions are

a powerful thing to overcome when you are watching the market move

against a profitable trade. Many traders live by the advice “Never let a

winner turn into a loser,” and use trailing stop losses to protect profit

MANAGE RISK CONSISTENTLY

Since we are on the topic of position sizing and risk percentages, traders

often make the mistake of risking inconsistent amounts. Either they believe

in one trade more than another or they are just terrible at calculating

MANAGING RISK THROUGH POSITION SIZE

Managing risk is all about controlling the amount of money you lose when

a trade doesn’t go your way. Many traders make the mistake of sizing their

positions too large and losing more money than they should on a single

trade. To determine position size, you first need to decide how much money

STOP THINKING ABOUT LOSSES IN PIPS

Whenever I do a presentation about trading long-term charts, I’m always

asked how many pips I risk on each trade. Many traders assume that trading

a daily or weekly chart requires risking a tremendous number of pips

on each trade, and they can’t afford that risk. This is a logical assumption

because many traders are conditioned by lessons on day trading to risk

a small number of pips when trading a smaller timeframe. The notion is

REDUCING YOUR TRANSACTION COSTS

In terms of risk, another reason I promote long-term trading is to reduce

transaction costs. Currency dealers are very good at marketing the notion

that somehow the currency market is cheaper to trade because there are

BEWARE OF OVERTRADING

Without capital in your account, you’re dead as a trader; therefore, protecting

your trading capital should be your top priority. Anytime you open

a trade you are placing capital at risk, so it is important to select only the

ALWAYS USE A STOP ORDER

I get at least one e-mail each month from a trader who has let a bad trade

get away from him. Usually the trader did not place a stop order on his

trade and the market moved against him, creating a significant loss. Closing

Managing Risk

Losing is part of trading, and sooner or later you will lose money on

a trade. How you handle risk is the single most important concept a

trader must understand to survive long term. Unfortunately, managing

risk is a confusing topic for many traders. Through my blog I’ve spoken

with traders from around the world who have made the same mistakes I did

as an inexperienced trader; the discussions in this chapter are a response

to those conversations.

In this chapter you will learn how to use stop orders, avoid overtrading,

size your positions correctly, and manage trailing stops appropriately.

Managing risk is a key principle of bargain hunting because you can’t trade

if you end up losing all your money. Arm yourself with the information in

this chapter and you’ll be prepared to protect your account capital from

the risks of trading currency.

TRADING PRICE ACTION

Identifying support and resistance is only half the battle; to make money,

you have to be able to trade them. There are a couple of tactics I prefer to

trade price action along support and resistance levels, and you will learn

those tactics in this section. You will see these tactics in action when we

discuss actual trading methodologies in Chapters 6 through 9. To trade

IDENTIFYING SUPPORT AND RESISTANCE

The trading methodologies in this book are built on the assumption that

you will build your skills as a support and resistance trader. Identifying

support and resistance isn’t difficult with a little practice. This section will

teach you the techniques I use to identify support and resistance. By the

end of this section you will be able to identify support and resistance levels

on any currency pair and any chart timeframe. You will learn to identify

UNDERSTANDING SUPPLY AND DEMAND

If technical indicators or oscillators do not drive price, then what does?

Viewing a currency chart, price seems to oscillate in a completely random

fashion, but under the hood what drives price is actually quite orderly. The

spot currency market is a competitive marketplace driven by the economic

model of supply and demand. Many factors influence the equilibrium between

supply and demand, causing shifts in the market price. When more

traders are willing to buy a currency than sell it, the price will move higher,seeking new sellers. The opposite effect occurs when more sellers exist

than buyers: prices fall.

Reading Price Action

Traders constantly search for an edge over other market participants

that will lead them to greater profits. Many traders have placed their

faith in technical indicators or oscillators to help them predict the

next move in price without regard to price itself. Unfortunately, indicators

and oscillators have no influence on the market, as we discussed in Chapter

2. Despite this fact, I still know traders who cover their charts with so

many indicators and oscillators they can’t even see the price bars, which is

unfortunate because the best indicator to predict the next move in price is

price itself.

In this chapter you will learn to read price action without the aid of

technical indicators or oscillators. This is a very important chapter for you

to consider, because reading price action through the study of support and

resistance is at the center of every trading methodology in this blog.

MANAGE YOUR PROFIT

Taking profit is often more difficult than taking a loss for many traders.

Unlike risk, reward is not a fixed variable. The market may move 10 pips

or 1,000 pips in your favor, and though you know how much you’ll lose

if the trade goes bad, you have no idea how much potential profit a trade

MANAGE YOUR RISK

The only factor a trader has under her control when a trade is opened is

risk. Managing the amount of money you lose when a trade goes bad is

critical to your longevity as a trader. The reality is that there is no safe

NEVER PAY FULL PRICE

In real estate it is said the real profit is made when you purchase the property,

not when you sell it. This adage means that when you purchase a

home or investment property, you should try to get the absolute best price

for the property. Paying as little as possible for a home will help you makethe most profit when you decide to sell it at a later time. Buyers who pay

market or get into bidding wars for a home are paying full price and will

have a much harder time making a profit than those smart enough to wait

for the best price.

LEARN TO READ PRICE ACTION

Humor me for a moment and consider this riddle: What is the difference

between a great bass guitarist and a great bass guitarist? It’s an impossible

riddle, right? Although both bass guitarists can play and entertain a crowd,

only one truly understands how music works. The other has simply memorized

notes and mastered a tempo. Without understanding how music is

LIVE YOUR LIFE

Why are you trading? Are you trying to fulfill a lifelong desire to wake up at

3:00 A.M. and stare at currency charts for 10 hours a day? I didn’t think so.

Unfortunately, I continue to meet traders who remain glued to their charts

for more than 10 hours a day! Ironically, for many of these traders their

effort doesn’t translate into additional profits. I don’t know your interest in

trading, but whatever the reason you trade, never forget that there is more

to life than trading!

Principles of a Bargain Hunter

Principles of aBargain Hunter

have paid less for something you just bought. From garage sales

to global finance, bargain hunters seek out the absolute best price,

whether they are buying velvet Elvis or 1 million euros. Under all the fancy

software, chart patterns, indicators, and analyst opinions, trading currency

has only one goal: to buy currency when it is dirt cheap and to sell it to

someone else for top dollar. Unfortunately, traders often get distracted

from the primary goal of trading to search out new or exotic trading systems

promising to have unlocked the secrets of trading currency. There is

no secret to making a profit, whether you’re running a pawn shop or trading

pounds. Your job as a trader is to buy at a value, sell at a premium, and

never pay full price.

Identifying a good deal in the currency market is a little more complicated

than telling the local car dealer you won’t pay sticker price. Traders

become bargain hunters by learning to read price action and then anticipating

the market’s next move. It takes discretion and experience to develop

a sixth sense about price action, and even an experienced bargain hunter

can get suckered from time to time. Bargain hunting is a large component

of the way I trade, because demanding the best price out of every trade

ultimately reduces risk and increases profit.

I have created five principles of a bargain hunter to frame my style of

discretionary support and resistance trading. The strategies described in

this book have their own guidelines for locating trades, but all are grounded

in the principles of bargain hunting. Each of the five principles is designed

to guide you through a specific trading task. From maintaining a healthywork and life balance to managing profit, the tenets of each principle in

this chapter must be met before I will take a trade. Pay close attention to

the material covered in this chapter; this is how I bargain hunt and I don’t

mind being called cheap. It’s a badge I wear proudly.

SELECTING A CURRENCY DEALER

The only partner a retail currency trader needs is a retail currency dealer.

No two dealers are alike, so care should be taken to select the very best

dealer as your trading partner. We discussed earlier that currency dealers

are different from stockbrokers because they routinely assume the full

EARNING INTEREST

The currency market is designed to facilitate the trade of money between

two parties interested in actually delivering the currency being traded. The

contracts traded on the spot market are designed to settle within two business

MARGIN AND LEVERAGE

Currency is traded in lot sizes ranging from 100- to 100,000-unit lots on the

retail spot market. Remember that a unit of currency could be a dollar,

euro, pound, or whatever your account denomination. By trading multiple

lots, a currency trader can hold a position of virtually any size, provided

ORDER TYPES

At some point you will have to place an order with your dealer to make any

money in the currency market. Opening, closing, and managing trades are

accomplished through four different order types. Market orders, entry orders,

stop orders, and limit orders all serve a specific role in trading on the

forex market. The implementation of each order type is slightly different

among currency brokers. Ensure that you have a firm grasp on how to use

your dealer’s software before you trade with real money.

TRADE MECHANICS

Trading currency is a process of exchanging one currency for another, so

each currency trade is actually two transactions happening at the same

time. One currency is bought while the other is sold. The forex market

quotes prices as currency pairs to facilitate the ease of trading one currency

FOREX VERSUS EXCHANGE MARKETS

The forex market is not structured like a traditional exchange market such

as the New York Stock Exchange or the Chicago Mercantile Exchange.

Forex is a decentralized global marketplace where trades are cleared one

on one between trading partners. There is no central exchange, no pit full

of yelling traders, no big board of quotes on a New York street, and no

closing bell to ring. The pros and cons of an exchange-based market versus

off-exchange currency trading are debatable, but there are obvious differences

you should understand before trading in the forex market.

FOREX PARTICIPANTS

Forex has a diverse population of participants, ranging from Japanese

housewives to powerful central bankers. The objectives of the participants

differ, and their individual actions may have dramatic affects on

the market. It is important to remember that the forex market is an offexchange

marketplace; there is no central exchange where all orders are

cleared, as on the New York Stock Exchange or the Chicago Mercantile

Exchange. The bulk of trading is done between trading partners on the

interbank; however, small retail traders are unable to trade directly with

partners on the interbank. Therefore, some participants in the forex market

exist to create a marketplace for others. Currency dealers create a

market for smaller retail speculators and offset their risk by trading with

their larger partners on the interbank. The hierarchy of forex participants

is illustrated in Figure 1.1. There is a definite food chain among forex

market participants, with interbank members on top and retail speculators

on the bottom.

FOREX ROOTS

The roots of our modern forex market are an interesting topic that has

been covered ad nauseum by other trading books; however, I do believe

it is important to have some knowledge of the market’s history, so this

section covers the key points. If you have never studied global monetary

systems, consider this section an abridged history of the forex market.

The modern forex market’s roots began with over-the-counter currency

trading desks established by banks throughout the 1970s and 1980s,

following the collapse of a postwar-era monetary system known as the

Bretton Woods system. Bretton Woods was established in June 1944, as

World War II came to a close. The Allied nations sought to establish a new

monetary system to promote global investment and capitalism and to eliminate

the challenges of a gold standard system.

WHAT IS FOREX?

The currency market, or more specifically the forex market, derives its

name from the generic term foreign exchange market. The forex market is

a decentralized global network of trading partners, including banks, public

and private institutions, retail dealers, speculators, and central banks involved

in the business of buying and selling money. The forex market is a

Exploring the Currency Market

Whether you trade stocks, commodities, currencies, or real estate

on Mars, it is important to understand the marketplace in which

you’re working. If you have little market experience, if you’re new

to currencies, or if you want to brush up on market basics, this chapter is

for you. This chapter does not contain an exhaustive history of the modern

foreign exchange (forex) market. Instead, we look at the market from the

perspective of an active trader. You will learn about the roots of the market,

its structure and participants, how currency trades are executed, and the

tools used to conduct business. If you have experience trading other markets,

this chapter will brief you on the unique attributes of the currency

market. If you have little or no experience in trading, the contents of this

chapter are an essential part of learning the business of currency trading.

Leading vs. Lagging Indicators

We've already covered a lot of tools that can help you analyze potential trending and range bound trade opportunities. Still doing great so far? Awesome! Let's move on.

Support and Resistance

Support and resistance is one of the most widely used concepts in trading. Strangely enough, everyone seems to have their own idea on how you should measure support and resistance.

The Big Three

Congratulations! You've gotten through the Pre-School and, with a few boo-boos here and there, you are ready to begin your first day of class!

You did go through the Pre-School, right????

What is Traded?

The simple answer is MONEY.

Because you're not buying anything physical, this kind of trading can be confusing.

Think of buying a currency as buying a share in a particular country, kinda like buying stocks of a company. The price of the currency is a direct reflection of what the market thinks about the current and future health of the Japanese economy.

What is Forex?

If you've ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet (if you're a dude) or purse (if you're a lady) or man purse (if you're a metrosexual) into the currency of the country you are visiting.

You go up to the counter and notice a screen displaying different exchange rates for different currencies. You find "Japanese yen" and think to yourself, "WOW! My one dollar is worth 100 yen?! And I have ten dollars! I'm going to be rich!!!" (This excitement is quickly killed when you stop by a shop in the airport afterwards to buy a can of soda and, all of a sudden, half your money is gone.)

Subscribe to:

Comments (Atom)

.jpg)