What would you think if I told you I lost money on 70 percent of my trades?

Would you scoff at my trading performance? Would you think I’m a bad

trader? Or would you be interested in knowing how much I made on the 30

percent of trades on which I made money? Traders tend to focus on winning

and taking profits because nobody likes to lose money and everybody

likes to talk about wins. Winning isn’t everything in trading, as you’ll soon

find out. Your winning percentage is not as important as your average win

versus your average loss. If you continue to take profits early, you could

hurt the ratio between average win and average loss and ultimately affect

your profitability. The tool used to help increase your average win versus

your average loss is a ratio known as the risk-to-reward ratio, and its

proper use along with position sizing will go a long way to raising your

overall success as a trader. The mistake many traders make is not sticking

to their plan once they have planned a trade with a proper risk-to-reward

ratio.

Traders are traditionally taught that they should strive for a risk-toreward

ratio of at least 2:1 on every trade. In other words, each trade

should earn two pips for every one pip risked. In a perfect world the 2:1

risk-to-reward ratio allows a trader to lose 50 percent of her trades and

still be profitable. The problem, of course, is that trading is rarely a perfect

world. Trades can be cut short of their profit targets when using a trailing

stop, the market could miss a profit target by only a few pips before

suddenly moving against you, and traders often lack the discipline necessary

to remain steadfast until their profit target is hit and they close their

trades prematurely. This is why I like to refer to the risk-to-reward ratio as a

risk-to-potential ratio instead. If you head into every trade knowing thatthe potential is there to mathematically cover your losses, hopefully you

will learn to stick to each trade and stop meddling with them. Overall,

striving for a large risk-to-reward ratio can help you improve your trading

results and should be a part of your risk management plan.

Go Big or Don’t Bother

Since risk-to-reward ratios are not a perfect science, my advice to you

when you’re planning a trade using risk-to-reward as a guide is to go big

or don’t trade at all. Planning a trade with anything less than a 1:4 risk-toreward

ratio doesn’t make any sense to me. Trades do not always reach

their profit targets, and if you are unable to make a profit on every trade,

using a lower ratio won’t help cover your losses if your winning percentage

is less than 50 percent. Waiting for trades that offer you the largest

potential reward for the least amount of risk will help ensure a profitable

result, even if the trade doesn’t reach its profit target. It is better to get a

risk-to-reward ratio of 1:2 on a trade you tried to get 1:5 on than it is to get

a breakeven result on a trade you tried to get 1:2. Do you understand the

difference? Over the long run, traders who wait for the big trades and stick

to their stops and profit targets will do better than traders taking any little

trade that comes their way.

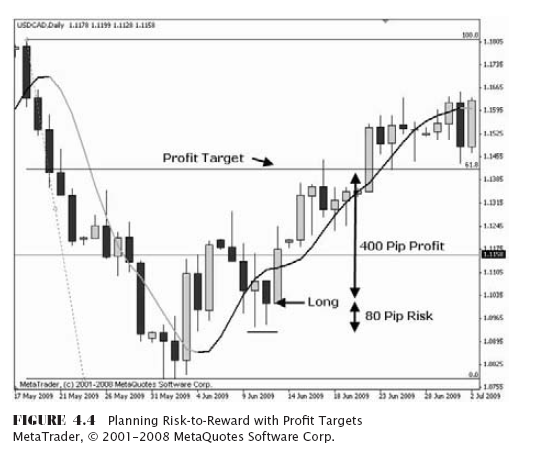

Figure 4.4 illustrates a trade planned using good risk-to-reward. In this

example, a trader bought USD/CAD during a pullback within an uptrend

on support and used Fibonacci to identify a profit target. This trade ultimately

offered a risk-to-reward ratio of 1:5. The example trade in Figure

4.4 also illustrates how a trailing stop loss isn’t necessarily the best

thing to use. If the trader did not use a limit order on his profit target

but trailed it with a two-day low stop loss, the trade would have been cut

short three days prior to the market rallying through the intended profit

target. Shooting for a risk-to-reward ratio of at least 1:4 on each trade will

allow you to lose more than 50 percent of the time and still be a profitable

trader.

The Numbers Don’t Lie

At the end of the trading day, the only thing that matters is whether you

have made money or lost money. Even if you plan each trade with a high

risk-to-reward ratio, it doesn’t mean that you will automatically be a profitable

trader. You must have the courage to hold each trade through to

the end and realize each profit target. This means that you may have to

watch a profitable trade give back its gains before the market reaches your

profit target. You might even have to sweat a little while a trade that was

once profitable dips into negative territory before moving on to your profit

target. This is where many traders fail to hold ranks with the disciplined

traders and start using breakeven stops or trailing stops. They can’t stand

the idea of losing on a trade that was once profitable, but you have to look

at the big picture to understand why that could in fact be good money

management.

If you start cutting your trades short, you won’t realize the profit target

you planned, and that changes your trading performance’s average riskto-

reward ratio. Each time you cut a trade short, you must increase your

winning percentage to compensate for the loss in profit. The higher your

required winning percentage, the harder it will be to maintain a profitable

trading record, as illustrated in Table 4.6.

The example data in Table 4.6 demonstrates how trader number 3

had to be 60 percent more accurate than trader number 1 to make the

same amount in profit. If the third trader’s winning percentage drops to

50 percent, he will break even over 10 trades; anything less than 50 percent

will result in a loss. Unfortunately, maintaining a 90 percent success ratio

month after month can be extremely difficult to do, but trader number 3 has

left himself with no other choice but to be right, because he is not making

more per trade than he is risking. Cutting your trades short, either through

trailing stops or a lack of discipline to stick it through to your profit target,

has a dramatic effect on your profitability.

No comments:

Post a Comment